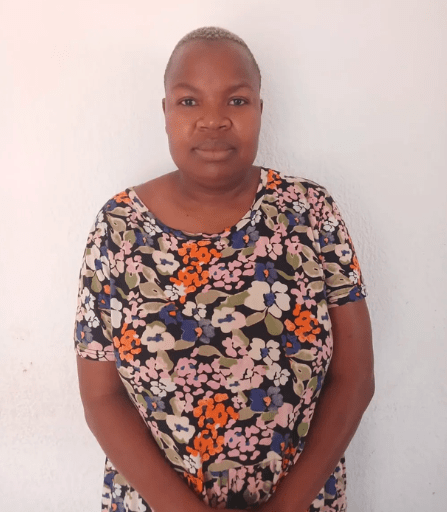

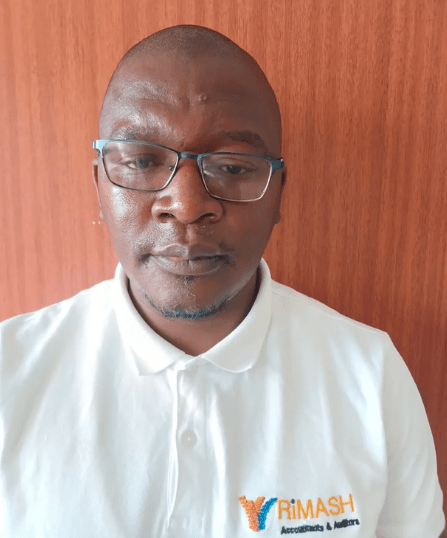

Woman, her company & staff in trouble for bid to defraud SARS of R1.6 million! Company director Mmaseala Kekana, bookkeeper Richard Sekgantsha Makgasa, and their business, Mmarekhu Retail and Suppliers CC, recently appeared before the Specialised Commercial Crime Court in Polokwane to face allegations of tax-related fraud.

The Alleged Fraudulent Scheme

The State alleges that during the 2013/2014 tax period, Kekana, Makgasa, and their company conspired to defraud the South African Revenue Service (SARS).

to Limpopo Hawks spokesperson Warrant Officer Lethunya Mmuroa, the accused unlawfully submitted false income tax returns with the intention of securing a fraudulent refund.

“The accused reportedly submitted false income tax returns to SARS and were about to be refunded the amount of R1,665,089,” said Mmuroa.

This case highlights ongoing concerns about fraudulent activities targeting South Africa’s tax system, undermining government revenue collection efforts.

Discovery of the Fraud

The irregularities in the accused’s tax submissions were discovered during a forensic audit conducted by SARS in 2022. The audit raised red flags, prompting SARS to open a case docket of fraud at Mokopane Police Station.

The case was subsequently referred to the Polokwane-based Hawks Serious Commercial Crime Investigation Unit for further investigation. After a detailed probe, the case was handed to the public prosecutor, who issued warrants for the arrest of Kekana, Makgasa, and their company.

Arrests and Court Proceedings

The trio was arrested on October 21, 2024, and summoned to appear before the Specialised Commercial Crime Court on November 15, 2024. The case has been postponed to November 22, 2024, to allow for further police investigations.

“The investigation was conducted, and upon finalisation of the case, it was handed to the public prosecutor for decision. As a result, the public prosecutor issued warrants for the arrests of the director, company, and the bookkeeper,” said Mmuroa.

Broader Context: Tax Fraud in South Africa

This case is part of a larger pattern of financial crimes targeting SARS. Tax fraud and money laundering have become significant concerns for authorities, requiring intensified efforts to curb these crimes.

In a separate case, the Nelspruit Specialised Commercial Crime Court recently convicted and sentenced 40-year-old Smangaliso Innocent Khoza for violations of the Prevention of Organised Crime Act (POCA) and the Tax Administration Act.

Khoza, a director of four companies, was implicated in a money laundering and tax evasion scheme. His charges were part of a broader investigation that initially brought eight individuals and companies to the Nelspruit Magistrate’s Court in 2021 for alleged tax evasion, theft, and money laundering.

The Impact of Financial Crimes on the Economy

Tax fraud not only disrupts revenue collection but also undermines public trust in the tax system. When companies and individuals engage in fraudulent practices, the government’s ability to fund essential services is compromised, affecting infrastructure, healthcare, and education.

Efforts by SARS and law enforcement agencies, such as forensic audits and collaboration with units like the Hawks, play a crucial role in identifying and prosecuting financial crimes.

Public and Legal Reaction

Cases such as these often spark public debate about corporate ethics and accountability. Many South Africans view these prosecutions as necessary steps toward restoring integrity within the country’s financial systems.

The court proceedings against Kekana, Makgasa, and Mmarekhu Retail and Suppliers CC are closely watched, as they serve as a reminder of the consequences of fraudulent activities.

Next Steps in the Case

With the case postponed to November 22, 2024, investigators will continue to gather evidence to strengthen the prosecution’s case. Meanwhile, SARS has reiterated its commitment to rooting out tax fraud and ensuring compliance with tax laws.

As the investigation unfolds, this case underscores the importance of vigilance and accountability in South Africa’s fight against financial crime.

In other news – Thuli Phongolo serves stunning photos on DJ Maphorisa’s birthday

Renowned producer and singer DJ Maphorisa recently celebrated his 37th birthday in style, hosting a grand party that became the talk of the town.

The event, held at Pharoah Motors, drew attention not only for its opulence but also for the A-list guest list that added a touch of glamour to the festivities. The birthday celebration featured a star-studded lineup of South African celebrities, all dressed in elegant black attire. Read More

More news – Former Uzalo and Generations actor Kay Sibiya gets married – Photos

Renowned South African DJ and actor Kay Sibiya has recently taken a significant step in his personal life, as he paid lobola for his longtime partner and the mother of his children, Judie Kama.

Known for his roles on popular television shows, Sibiya has captivated audiences both on and off-screen, and his latest milestone has drawn the attention and well-wishes of fans and friends alike. Read More

#Woman #company #staff #trouble #bid #defraud #SARS #R1.6 #million